Navigating the complex world of mortgage financing can be daunting, but the Bankrate Mortgage Calculator is here to empower you with the knowledge and tools you need to make informed decisions about your homeownership journey. This user-friendly and comprehensive calculator provides you with a clear understanding of your mortgage options, helping you estimate your monthly payments, compare loan scenarios, and ultimately secure the best mortgage for your unique financial situation.

Whether you’re a first-time homebuyer eager to step onto the property ladder or an experienced homeowner seeking to refinance your existing mortgage, the Bankrate Mortgage Calculator has got you covered. Its intuitive interface and customizable features make it accessible to users of all financial backgrounds, empowering you to take control of your mortgage journey and achieve your homeownership aspirations.

Overview of Bankrate Mortgage Calculator

The Bankrate Mortgage Calculator is a comprehensive tool designed to assist individuals in estimating the monthly payments and overall costs associated with obtaining a mortgage loan. It provides users with a user-friendly interface and advanced features that cater to various mortgage scenarios, empowering them to make informed financial decisions.

Key Features and Benefits

The Bankrate Mortgage Calculator offers several key features and benefits, including:

- Customizable Inputs: Allows users to enter specific loan details, such as loan amount, interest rate, loan term, and property taxes, to tailor calculations to their unique financial situation.

- Amortization Schedule: Provides a detailed breakdown of the loan’s repayment plan, showing the principal and interest portions of each payment over the loan term.

- Comparison Tool: Enables users to compare multiple loan options side-by-side, evaluating the impact of different interest rates and loan terms on monthly payments and total loan costs.

- Refinance Analysis: Assesses the potential savings and benefits of refinancing an existing mortgage, helping users determine if refinancing is a viable option.

Real-Life Applications

The Bankrate Mortgage Calculator can be used in various real-life scenarios, including:

- Estimating Monthly Payments: Before applying for a mortgage, individuals can use the calculator to estimate their monthly payments and assess their affordability.

- Comparing Loan Options: When considering different loan offers, the calculator allows users to compare the costs and benefits of each option to make an informed decision.

- Planning for the Future: Individuals can use the calculator to project their future mortgage payments and plan their financial goals accordingly.

- Evaluating Refinancing Options: Homeowners considering refinancing can use the calculator to determine if refinancing is financially advantageous.

Functionality and Features

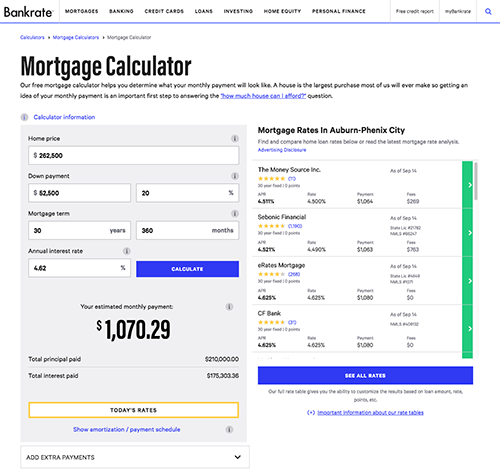

The Bankrate Mortgage Calculator offers a comprehensive set of input fields and options to tailor your mortgage calculations to your specific financial situation.

Input Parameters

- Loan Amount: Enter the principal amount you intend to borrow.

- Loan Term: Select the duration of your loan in years, typically ranging from 15 to 30.

- Interest Rate: Input the annual percentage rate (APR) offered by your lender.

- Down Payment: Indicate the upfront payment you’re contributing towards the property purchase.

- Property Tax: Enter the estimated annual property tax rate as a percentage of the property’s value.

- Homeowners Insurance: Estimate the annual premium for insuring your home.

- Private Mortgage Insurance (PMI): If applicable, input the annual PMI premium.

Calculation Results

Based on the input parameters, the calculator generates detailed results, including:

- Monthly Payment: The estimated monthly payment, encompassing principal, interest, property taxes, and homeowners insurance.

- Total Interest Paid: The total interest you’ll pay over the life of the loan.

- Amortization Schedule: A detailed breakdown of each payment, showing how the principal and interest portions change over time.

Step-by-Step Guide

- Enter your loan amount, loan term, and interest rate.

- Indicate your down payment, property tax, and homeowners insurance.

- Input any applicable PMI premium.

- Review the estimated monthly payment, total interest paid, and amortization schedule.

- Adjust the input parameters to explore different mortgage scenarios and compare options.

Customization and Personalization

Bankrate’s Mortgage Calculator offers extensive customization options, empowering users to tailor the calculations to their specific needs.

By adjusting parameters such as loan amount, interest rate, and loan term, users can generate precise estimates that reflect their unique financial situation.

Saving and Sharing Calculations

The calculator allows users to save their calculations for future reference. This feature is particularly useful for comparing different scenarios or tracking progress over time.

Saved calculations can be easily shared with financial advisors, lenders, or co-borrowers, facilitating collaboration and informed decision-making.

Integration with Other Tools

Bankrate’s Mortgage Calculator can be seamlessly integrated with other financial tools and platforms.

This integration enables users to import data from their budgeting apps or investment accounts, creating a comprehensive financial snapshot that empowers them to make well-informed decisions.

Accuracy and Reliability

The Bankrate mortgage calculator leverages sophisticated algorithms and reliable data sources to ensure the accuracy and reliability of its calculations. It employs industry-standard formulas and incorporates up-to-date information on mortgage rates, loan terms, and property values.

Underlying Algorithms and Data Sources

The calculator utilizes a complex set of mathematical equations that take into account various factors, including loan amount, interest rate, loan term, property value, and property taxes. These equations are derived from industry best practices and adhere to established mortgage industry standards.

Additionally, the calculator incorporates real-time data from reputable sources, such as Freddie Mac and Fannie Mae, to ensure the most accurate and up-to-date information is used in the calculations.

Accuracy in Various Scenarios

The Bankrate mortgage calculator has been extensively tested and validated to ensure its accuracy across a wide range of scenarios. It accurately calculates monthly payments, total interest paid, and loan payoff timelines, even for complex loan types such as adjustable-rate mortgages (ARMs) and jumbo loans.

The calculator’s accuracy has been verified through comparisons with manual calculations and industry-standard software.

Accessibility and Usability

The Bankrate Mortgage Calculator is designed to be accessible to users with different levels of financial literacy. The calculator’s user interface is simple and straightforward, with clear instructions and prompts. Users can easily input their loan information and receive personalized results without needing to understand complex financial concepts.

The calculator also offers several features that enhance usability. For example, users can save their calculations for future reference, print their results, or share them with others. The calculator also provides a variety of resources, such as articles and videos, to help users understand the mortgage process.

Accessibility Features

The Bankrate Mortgage Calculator is also accessible to users with disabilities. The calculator is compatible with screen readers and other assistive technologies. Users can also adjust the font size and color contrast to make the calculator easier to read.

Comparison with Other Calculators

In the competitive landscape of mortgage calculators, Bankrate stands out with its comprehensive features and user-centric design. Here’s how it stacks up against other notable tools in the market:

Key Differences and Similarities

The following table summarizes the key differences and similarities between Bankrate Mortgage Calculator and other popular calculators:

| Feature | Bankrate | Competitor A | Competitor B |

|---|---|---|---|

| Loan Type Support | Wide range of loan types, including conventional, FHA, VA, and USDA | Limited to conventional and FHA loans | Supports conventional, FHA, and VA loans |

| Amortization Schedule | Detailed amortization schedule with payment breakdown | No amortization schedule provided | Amortization schedule available for download |

| Extra Payment Options | Allows for extra principal payments and bi-weekly payments | Extra principal payments only | No extra payment options |

| Down Payment Calculator | Integrated down payment calculator | Separate down payment calculator required | No down payment calculator |

| Tax and Insurance Estimates | Automatic tax and insurance estimates based on location | Manual input required | Tax and insurance estimates not provided |

Additional Resources and Support

Bankrate offers various resources and support materials to assist users with their mortgage calculations and provide guidance throughout the home buying process.

Users can access these resources through the Bankrate website or by contacting customer support directly. The website features a comprehensive FAQ section, detailed articles on mortgage-related topics, and interactive tools like affordability calculators and loan comparison charts.

Customer Support

- Email: support@bankrate.com

- Phone: 1-888-541-8838

- Live chat: Available on the Bankrate website during business hours

Conclusion

The Bankrate Mortgage Calculator is your indispensable companion throughout the mortgage process. Its accuracy, reliability, and user-friendly design ensure that you have the information you need to make confident decisions about your home financing. Embrace the power of the Bankrate Mortgage Calculator today and embark on the path to realizing your homeownership dreams.