In today’s dynamic business environment, protecting your assets and reputation is crucial. General liability insurance serves as a vital safeguard against financial risks, offering peace of mind and ensuring the longevity of your enterprise. This comprehensive guide will delve into the intricacies of general liability insurance, empowering you to make informed decisions for your business.

General liability insurance provides coverage for a wide range of potential liabilities, from bodily injury and property damage to advertising injuries and legal defense costs. By understanding the key elements, benefits, and considerations involved, you can tailor an insurance policy that meets the specific needs of your business, safeguarding it from unforeseen events.

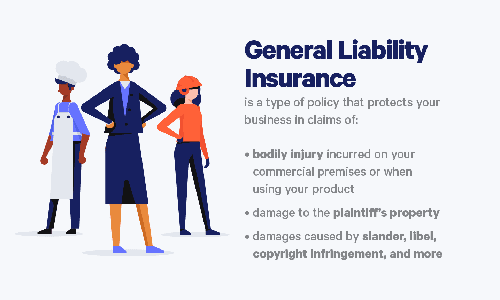

Definition of General Liability Insurance

General liability insurance is a type of business insurance that protects companies from financial losses due to claims of bodily injury or property damage caused by their operations, products, or services.

Common scenarios covered by general liability insurance include:

- Customer slips and falls in a store.

- A product malfunction causes injury or property damage.

- An employee’s negligence leads to an accident.

Key Elements of General Liability Insurance Policies

General liability insurance policies provide a comprehensive range of coverage to protect businesses from potential legal liabilities arising from their operations. These policies typically include several key elements that define the scope and limitations of coverage.

Coverage Limits

Coverage limits refer to the maximum amount of financial protection provided by the insurance policy. These limits are typically expressed in terms of per-occurrence and aggregate limits. Per-occurrence limits specify the maximum amount payable for a single claim or incident, while aggregate limits represent the total amount payable for all claims during the policy period.

Coverage limits vary depending on the size and risk profile of the business.

Exclusions and Limitations

General liability insurance policies also contain exclusions and limitations that restrict coverage in certain situations. Common exclusions include:

- Intentional acts

- Criminal acts

- Pollution or environmental damage

- Professional negligence

- Workers’ compensation claims

Limitations may apply to specific types of coverage, such as caps on legal defense costs or limits on coverage for certain types of damages (e.g., punitive damages). Understanding these exclusions and limitations is crucial for businesses to ensure adequate coverage for their specific needs.

Benefits of General Liability Insurance

General liability insurance offers a crucial safety net for businesses, protecting them from the financial burden of legal liabilities and damages arising from third-party claims. It safeguards businesses against unforeseen incidents and accidents, ensuring their financial stability and peace of mind.

Numerous businesses have reaped the benefits of general liability insurance, enabling them to weather financial storms and maintain their operations smoothly. Let’s delve into some real-life case studies:

Case Study: Restaurant Liability

A popular restaurant experienced a foodborne illness outbreak, resulting in several patrons becoming ill. The restaurant’s general liability insurance covered the medical expenses, legal defense costs, and settlement payments, preventing the business from facing financial ruin.

Case Study: Construction Liability

During a construction project, a subcontractor accidentally damaged a neighboring property. The general liability insurance policy of the main contractor covered the repair costs and legal expenses, protecting both the subcontractor and the main contractor from financial setbacks.

Considerations When Purchasing General Liability Insurance

To determine the appropriate coverage limits, businesses should assess their potential risks, including the size of their operations, industry, and location. Factors such as the number of employees, revenue, and assets should also be considered. By understanding these factors, businesses can determine the level of coverage necessary to protect themselves from financial losses.

When comparing general liability insurance policies, it’s crucial to evaluate the following aspects:

Policy Coverage

- Ensure the policy covers the specific risks faced by the business, such as bodily injury, property damage, and advertising injuries.

- Review the exclusions and limitations to understand what is not covered by the policy.

Coverage Limits

- Determine the maximum amount the insurance company will pay for each type of claim.

- Consider purchasing higher coverage limits if the business faces significant risks or has valuable assets.

Deductible

- Choose a deductible that balances affordability with the desired level of coverage.

- A higher deductible typically lowers the premium, but it also increases the out-of-pocket expenses in the event of a claim.

Premium

- Compare the premiums offered by different insurance companies.

- Consider factors such as the coverage limits, deductible, and the business’s claims history.

Insurance Company

- Research the reputation and financial stability of the insurance company.

- Read reviews and consult with industry experts to gather insights about the company’s claims handling and customer service.

Common Exclusions and Limitations

General liability insurance policies typically contain exclusions and limitations that restrict the coverage provided. These exclusions and limitations are designed to protect the insurer from excessive risk and ensure that the policy remains affordable for policyholders.

Some of the most common exclusions and limitations in general liability insurance policies include:

- Intentional acts

General liability insurance does not cover damages resulting from intentional acts, such as assault, battery, or defamation. This is because insurers are not willing to provide coverage for acts that are deliberate and malicious.

- Criminal acts

General liability insurance does not cover damages resulting from criminal acts, such as theft, fraud, or arson. This is because insurers are not willing to provide coverage for acts that are illegal.

- Contractual liability

General liability insurance does not cover damages resulting from contractual liability, such as breach of contract or warranty. This is because contractual liability is a separate type of coverage that is typically provided by a commercial general liability (CGL) policy.

- Professional liability

General liability insurance does not cover damages resulting from professional liability, such as malpractice or negligence. This is because professional liability is a separate type of coverage that is typically provided by a professional liability policy.

- Pollution

General liability insurance does not cover damages resulting from pollution, such as environmental contamination or toxic spills. This is because pollution is a separate type of coverage that is typically provided by a pollution liability policy.

- War

General liability insurance does not cover damages resulting from war, such as acts of terrorism or military conflict. This is because war is a separate type of coverage that is typically provided by a war risk policy.

Additional Coverages and Endorsements

General liability insurance policies can be customized to meet the specific needs of businesses. Additional coverages and endorsements can be added to provide broader protection against various risks.

Additional Coverages

- Product Liability Coverage: Protects businesses against claims alleging that their products caused bodily injury or property damage to third parties.

- Completed Operations Coverage: Extends coverage to work performed by the insured that causes injury or damage after the project is completed.

- Cyber Liability Coverage: Provides protection against financial losses resulting from data breaches, cyber attacks, and other electronic security risks.

Endorsements

- Waiver of Subrogation: Removes the insurer’s right to pursue the insured for reimbursement if the insured is found liable for a third-party claim.

- Increased Limits of Liability: Raises the maximum amount of coverage available to the insured in the event of a large claim.

- Additional Insured Endorsement: Adds additional parties, such as landlords or contractors, as insureds under the policy.

Claims Process

Filing a general liability insurance claim involves several steps. Understanding these steps and following best practices can increase the likelihood of a successful claim.

When a covered incident occurs, the policyholder should promptly notify their insurance company. They will provide guidance on the claims process and assign a claims adjuster to investigate the incident.

Documenting the Incident

- Gather all relevant documentation, such as police reports, witness statements, and medical records.

- Take photos or videos of the scene and any injuries or damage.

- Keep a record of all expenses related to the incident, including medical bills and lost wages.

Cooperating with the Insurance Company

- Provide the claims adjuster with all requested information and documentation.

- Attend any scheduled meetings or inspections.

- Be honest and accurate in all communications with the insurance company.

Settlement and Payment

- The claims adjuster will review the evidence and determine the amount of coverage available.

- The insurance company will negotiate a settlement with the claimant or their attorney.

- Once the settlement is agreed upon, the insurance company will issue payment to the claimant.

Regulations and Legal Compliance

Many businesses are legally required to carry general liability insurance to protect themselves from potential liabilities and lawsuits. Failure to maintain adequate coverage can result in severe consequences, including financial penalties and legal repercussions.

Legal Requirements

- State Laws: Many states have laws requiring businesses to carry general liability insurance, especially those operating in high-risk industries.

- Industry Regulations: Certain industries, such as healthcare and construction, may have specific regulations mandating general liability insurance coverage.

- Contracts: Some contracts with clients or vendors may require businesses to maintain general liability insurance as a condition of the agreement.

Consequences of Inadequate Coverage

- Financial Penalties: Businesses without adequate general liability insurance may face fines or penalties imposed by regulatory agencies.

- Lawsuits and Liability: Uninsured businesses are vulnerable to lawsuits and can be held personally liable for damages and injuries caused to others.

- Business Closure: Severe financial losses resulting from lawsuits can force businesses to close down.

Closing Summary

General liability insurance is an essential investment for any business seeking to mitigate financial risks and maintain operational stability. By carefully assessing your coverage needs, understanding the policy exclusions and limitations, and exploring additional coverages, you can create a robust insurance plan that protects your business, its employees, and your customers.

Remember, the peace of mind and financial security provided by general liability insurance are invaluable assets for any business looking to thrive in today’s competitive market.